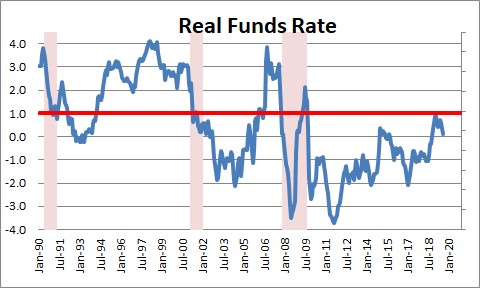

Translation: You could see lower interest rates on credit. What happens when the Fed cuts interest rates? One of the Fed’s goals with a rate cut is to make borrowing less costly. What goes up and what comes down with a Fed rate cut If you’re wondering, “What does a Fed rate cut mean for my finances?” the experts have answers. When that rate goes down (or up), the effects trickle down to you and the financial products you use every day-think credit cards, loans, and savings accounts.Įven if you don’t typically follow financial headlines, understanding what happens when the Fed cuts interest rates can help you make smart financial decisions when it comes to borrowing, saving, and spending. While it may sound like a fancy finance term, the federal funds rate is the interest rate banks charge each other to lend funds overnight. It’s just a bunch of news for policymakers, economists, and investors playing the market. By raising the federal funds rate or lowering it, the Fed tries to influence the cost of borrowing money, which can curb or boost inflation.Īlright, this may all seem pretty high-level. To reach those goals, the Fed uses one of its most powerful tools: interest rates. economy toward strong employment and stable prices. Since its inception, the Federal Reserve, a.k.a. Sales of government bonds to the public.Wondering how a lower Fed rate impacts you? It’s a good question. Purchases of government bonds from banks. Which of the following actions by the Fed would cause the money supply to increase? A.

raise interest rates and restrict the availability of bank credit. The purpose of a restrictive monetary policy is to: A. lowers both the interest rate and aggregate demand.

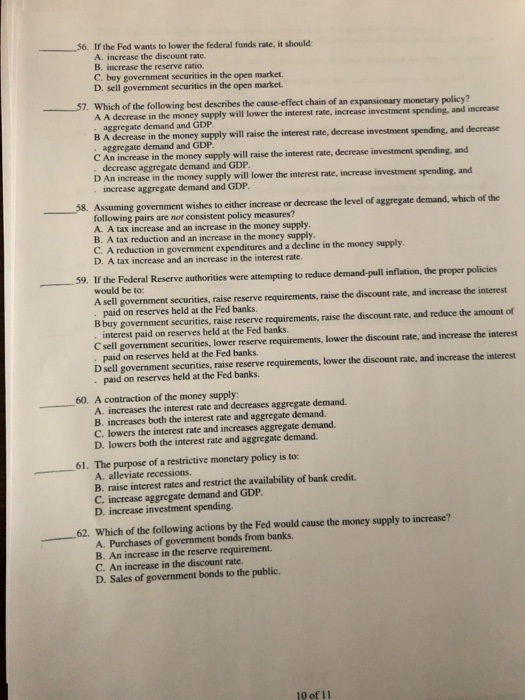

lowers the interest rate and increases aggregate demand. increases both the interest rate and aggregate demand. increases the interest rate and decreases aggregate demand. D sell government securities, raise reserve requirements, lower the discount rate, and increase the interest - paid on reserves held at the Fed banks. Csell government securities, lower reserve requirements, lower the discount rate, and increase the interest - paid on reserves held at the Fed banks. interest paid on reserves held at the Fed banks. B buy government securities, raise reserve requirements, raise the discount rate, and reduce the amount of. paid on reserves held at the Fed banks.If the Federal Reserve authorities were attempting to reduce demand-pull inflation, the proper policies would be to: A sell government securities, raise reserve requirements, raise the discount rate, and increase the interest A tax increase and an increase in the interest rate. A reduction in government expenditures and a decline in the money supply. A tax reduction and an increase in the money supply. A tax increase and an increase in the money supply. Assuming government wishes to either increase or decrease the level of aggregate demand, which of the following pairs are not consistent policy measures? A. DAn increase in the money supply will lower the interest rate, increase investment spending, and.

C An increase in the money supply will raise the interest rate, decrease investment spending, and decrease aggregate demand and GDP. BA decrease in the money supply will raise the interest rate, decrease investment spending, and decrease - aggregate demand and GDP. Which of the following best describes the cause-effect chain of an expansionary monetary policy? AA decrease in the money supply will lower the interest rate, increase investment spending, and increase - aggregate demand and GDP. sell government securities in the open market. buy government securities in the open market. If the Fed wants to lower the federal funds rate, it should: A.

0 kommentar(er)

0 kommentar(er)